Carboxymethyl Cellulose Price Forecasting for Petroleum Drilling Operations

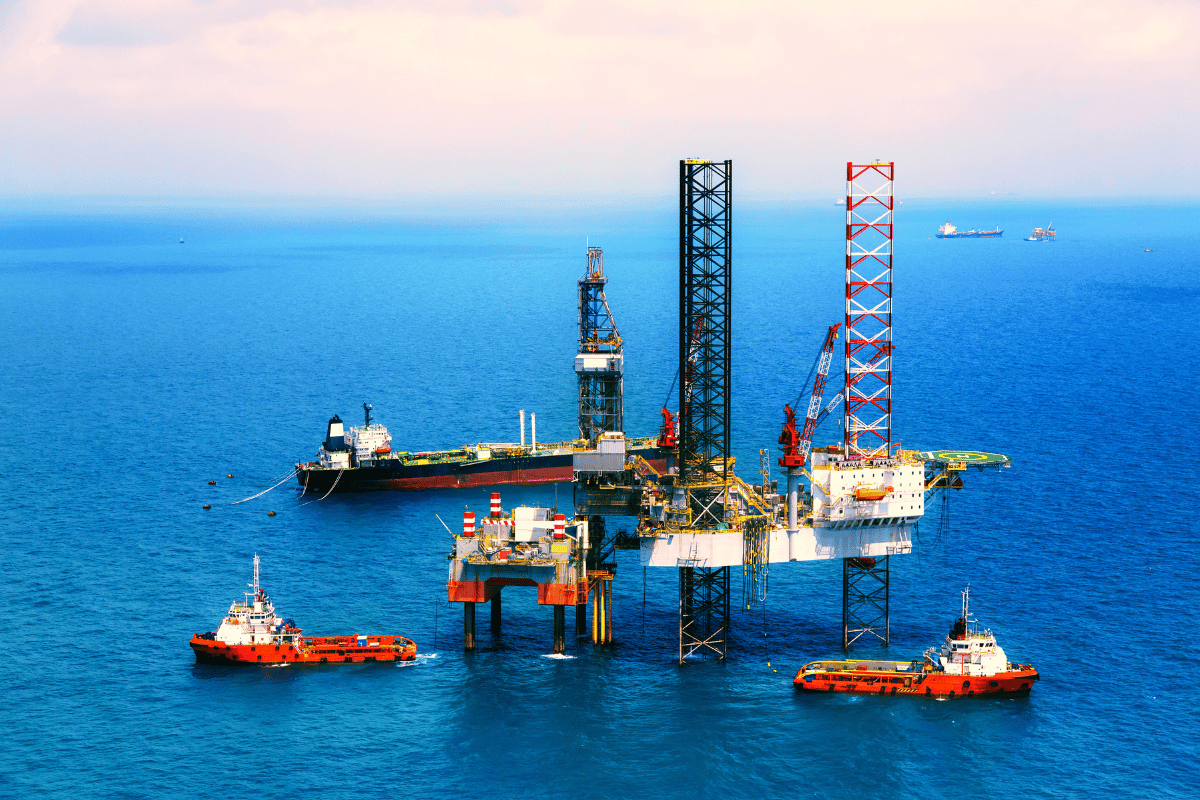

In the intricate landscape of petroleum drilling operations, where precision and efficiency are paramount, the role of Carboxymethyl Cellulose (CMC) cannot be overstated. This versatile compound finds its place as a crucial ingredient in drilling fluid systems, contributing significantly to the industry's productivity and safety. As we embark on this exploration, the objective is to delve into the intricate world of CMC pricing and its implications for petroleum drilling operations.

Within the petroleum drilling realm, where every decision can impact costs and outcomes, understanding the dynamics of Carboxymethyl Cellulose price forecasting becomes indispensable. This article serves as a compass, guiding us through the intricacies of CMC pricing, historical trends, forecasting methodologies, and its profound relevance in the context of petroleum drilling. As we navigate this journey, it becomes clear that accurate CMC price forecasting is not merely a financial exercise but a strategic tool that can significantly enhance operational efficiency and cost-effectiveness.

Now, let's embark on this expedition to unravel the intricate dance of CMC prices and their profound impact on the petroleum drilling industry.

Carboxymethyl Cellulose (CMC): An Essential Component

To comprehend the significance of Carboxymethyl Cellulose (CMC) in the realm of petroleum drilling operations, we must first acquaint ourselves with the remarkable nature of this versatile compound.

What is Carboxymethyl Cellulose (CMC)?

At its core, CMC is a water-soluble polymer derived from cellulose, which itself is extracted from wood pulp or cotton. Through a chemical modification process, carboxymethyl groups are introduced onto the cellulose backbone, resulting in the formation of CMC. This alteration imparts a unique set of properties to CMC, making it an invaluable ingredient in a multitude of industrial applications.

CMC's Significance in Drilling Fluid Systems:

In the context of petroleum drilling operations, CMC serves as an integral component of drilling fluid systems. Here's why it's considered indispensable:

- Rheological Control: CMC plays a pivotal role in controlling the rheological properties of drilling fluids. It influences the fluid's viscosity and flow characteristics, crucial for optimal drilling performance. This control helps prevent issues like lost circulation, where drilling fluids escape into porous formations.

- Filtration Control: Drilling fluids must effectively filter out solid particles generated during drilling to maintain the integrity of the wellbore. CMC forms a filter cake on the wellbore walls, preventing the invasion of fine particles and maintaining wellbore stability.

- Stabilization: The drilling process exposes formations to various pressures and temperatures. CMC enhances the stability of drilling fluids under these conditions, ensuring consistent performance and minimizing the risk of wellbore collapse.

- Fluid Loss Control: CMC's ability to form a barrier on wellbore surfaces helps control fluid loss into formations, reducing drilling fluid costs and maintaining wellbore integrity.

- Environmental Compatibility: As an eco-friendly and biodegradable compound, CMC aligns with the industry's growing emphasis on environmental responsibility. It ensures that drilling fluids can be disposed of safely, minimizing ecological impact.

The Role of CMC in Improving Drilling Efficiency and Safety:

Efficiency and safety are paramount in petroleum drilling, and CMC contributes significantly to both aspects. By optimizing drilling fluid properties, CMC enhances the drilling process's efficiency, reducing operational downtime and costs. Additionally, its ability to prevent wellbore instability and fluid loss enhances safety by minimizing drilling hazards.

In essence, Carboxymethyl Cellulose emerges as a linchpin in petroleum drilling operations, where precision and reliability are non-negotiable. Its multifaceted properties make it an invaluable asset, driving drilling efficiency, safety, and cost-effectiveness. As we delve deeper into the intricacies of CMC pricing and its forecasting, we gain a profound appreciation for the central role it plays in this critical industry.

Factors Influencing Carboxymethyl Cellulose Price

The price of Carboxymethyl Cellulose (CMC), a crucial component in drilling fluid systems for petroleum operations, is subject to a dynamic interplay of factors. Understanding these influential elements is key to comprehending CMC price fluctuations and forecasting trends accurately. In this section, we delve into the primary factors that exert their influence on the pricing of CMC.

1. Raw Material Costs: The foundation of CMC production lies in cellulose, typically sourced from wood pulp or cotton. Any fluctuations in the prices of these raw materials directly impact CMC production costs. Factors affecting raw material costs include weather conditions affecting crop yields, supply chain disruptions, and market demand for cellulose sources.

2. Production Process: The manufacturing process of CMC involves several steps, including cellulose etherification, purification, and drying. Energy costs, process efficiencies, and innovations in production techniques play a significant role in determining the cost of manufacturing CMC.

3. Market Demand and Supply: Like any commodity, CMC is subject to the laws of supply and demand. Fluctuations in the petroleum drilling industry's activity levels directly affect the demand for CMC. For instance, increased drilling activities may lead to higher CMC demand and, consequently, price increments.

4. Technological Advancements: Innovations in CMC production technologies can impact pricing. More efficient processes or new production methods can reduce manufacturing costs, potentially leading to price adjustments.

5. Global Economic Factors: Economic conditions on a global scale can affect CMC prices. Factors such as exchange rates, inflation, and geopolitical stability can influence the cost of importing or exporting CMC.

6. Environmental and Regulatory Factors: Increasing emphasis on environmental regulations and sustainability practices can lead to additional costs related to compliance, which may be passed on to consumers in the form of higher prices for eco-friendly CMC variants.

7. Competition in the CMC Market: The presence of multiple manufacturers and suppliers in the CMC market can lead to competitive pricing strategies. Intense competition may result in price stability or even reductions to capture market share.

8. Transportation Costs: The logistics of transporting CMC to its end-users can impact pricing. Fluctuations in fuel prices, shipping rates, and transportation infrastructure can all influence the final cost of CMC.

9. Quality and Purity: The quality and purity of CMC can vary between manufacturers and suppliers. Higher-quality CMC, often accompanied by stringent quality control measures, may command premium prices due to its reliability and performance benefits.

10. Economic Cycles: Broader economic cycles, such as recessions or economic booms, can affect CMC prices. During economic downturns, reduced drilling activity may lead to decreased CMC demand and potentially lower prices.

Understanding these factors is vital for industry stakeholders, as they enable informed decision-making regarding CMC procurement and inventory management. Accurate price forecasting in the context of petroleum drilling operations requires a comprehensive analysis of these factors and their intricate interactions within the market. In the subsequent sections, we will explore historical pricing trends and forecasting methodologies to gain deeper insights into this critical aspect of the industry.

Historical Pricing Trends

In the world of commodities, understanding historical pricing trends is akin to peering into the past to anticipate the future. The pricing history of Carboxymethyl Cellulose (CMC), a vital component in petroleum drilling operations, provides invaluable insights into its market dynamics and sets the stage for accurate price forecasting.

Analyzing Historical Pricing Trends:

Historical CMC pricing data, spanning several years or even decades, reveals patterns and fluctuations that are influenced by various factors. Here are some key observations and insights derived from historical pricing trends:

1. Price Volatility: CMC prices have exhibited a degree of volatility, with periodic fluctuations influenced by factors such as raw material costs, market demand, and global economic conditions. These fluctuations have underscored the importance of proactive price management strategies in the petroleum drilling industry.

2. Demand-Driven Peaks: Periods of increased drilling activity, often linked to fluctuations in oil prices, have corresponded with spikes in CMC demand and subsequent price increases. This highlights the direct connection between industry activity levels and CMC pricing.

3. Raw Material Impact: Significant shifts in the prices of cellulose-derived raw materials, driven by factors like crop yields, natural disasters, or supply chain disruptions, have had a cascading effect on CMC prices. The correlation between raw material costs and CMC pricing is evident in historical data.

4. Technological Advancements: Instances of price stabilization or even reduction have occurred following technological advancements in CMC production. More efficient manufacturing processes have contributed to cost savings, which can be reflected in pricing trends.

5. Economic Cycles: CMC prices have mirrored broader economic cycles. During economic downturns, reduced drilling activity and cost-consciousness have contributed to more stable or even lower CMC prices. Conversely, economic upturns have often correlated with increased CMC demand and pricing.

6. Environmental Factors: The growing emphasis on environmental responsibility has led to the development of eco-friendly CMC variants. These products may command higher prices due to additional costs associated with compliance with environmental regulations and sustainability practices.

7. Quality Differentiation: Historically, CMC suppliers offering higher-quality and purer CMC variants have been able to command premium prices. These products are often chosen for their reliability and performance benefits in critical drilling operations.

8. Competitive Market Dynamics: The presence of multiple manufacturers and suppliers in the CMC market has contributed to competitive pricing strategies. Fierce competition may lead to price stability or even reductions as companies vie for market share.

9. Transportation Costs: Fluctuations in fuel prices, shipping rates, and transportation infrastructure have impacted the logistics and, consequently, the final cost of CMC. These variables have influenced pricing trends over time.

10. Regulatory Changes: Regulatory shifts, both in terms of quality standards and environmental regulations, have influenced CMC prices. Compliance costs may lead to price adjustments.

By delving into these historical pricing trends, industry stakeholders gain valuable context for navigating the complex landscape of CMC pricing. This historical perspective serves as a foundation for the development of robust price forecasting methodologies, which we will explore in the following section. Accurate forecasting, informed by historical data and a comprehensive understanding of market dynamics, is instrumental in enhancing cost-effectiveness and operational efficiency in petroleum drilling operations.

Forecasting Methodologies

Accurate price forecasting for Carboxymethyl Cellulose (CMC) in the context of petroleum drilling operations demands a nuanced approach that blends statistical analysis, market insights, and industry expertise. In this section, we delve into the various methodologies employed for CMC price forecasting, highlighting their strengths and considerations.

1. Statistical Models:

Statistical modeling involves the use of historical pricing data, coupled with mathematical algorithms, to identify patterns and trends. Common statistical models used for CMC price forecasting include time series analysis, regression analysis, and machine learning algorithms. These models can provide quantitative forecasts based on historical data, offering a data-driven approach to prediction.

Considerations: Statistical models rely heavily on historical data quality and relevance. Ensuring that the chosen model accounts for factors influencing CMC pricing is crucial. Additionally, models should be regularly updated to adapt to changing market dynamics.

2. Market Analysis:

Comprehensive market analysis involves a deep dive into the broader petroleum drilling industry and its associated trends. It considers factors such as drilling activity levels, oil prices, and regulatory changes that impact CMC demand. This qualitative approach leverages industry expertise and insights to anticipate pricing shifts.

Considerations: Market analysis requires access to up-to-date industry information and the ability to interpret its implications for CMC pricing. An accurate assessment of market sentiment and demand drivers is essential for reliable forecasting.

3. Expert Opinions:

Seeking insights from experts in the field, including CMC manufacturers, industry analysts, and petroleum drilling professionals, can yield valuable qualitative information. Expert opinions can provide a holistic view of market conditions and potential price drivers.

Considerations: Expert opinions should be sourced from individuals with a deep understanding of both the CMC market and the petroleum drilling industry. The challenge lies in aggregating and synthesizing diverse expert perspectives into a coherent forecast.

4. Industry Insights:

Collaboration with industry associations and monitoring industry publications can yield real-time insights into market trends and emerging factors that may influence CMC prices. Staying connected to industry developments ensures that forecasts remain relevant.

Considerations: Industry insights require continuous monitoring and a keen eye for emerging trends. Timeliness and accuracy of information sources are critical for effective forecasting.

5. Technology and Data Analysis:

Leveraging advanced data analytics and technology, such as big data analytics and predictive modeling, can enhance forecasting accuracy. These methods can process vast amounts of data from various sources to identify hidden patterns and potential price drivers.

Considerations: Implementing advanced technology may require significant resources and expertise in data analysis. The quality and relevance of data sources are paramount for the success of this approach.

6. Scenario Planning:

Scenario planning involves creating multiple hypothetical scenarios based on different combinations of factors that could impact CMC prices. Each scenario considers a unique set of variables, enabling decision-makers to prepare for a range of possible outcomes.

Considerations: Scenario planning is valuable for risk mitigation, allowing for contingency plans in volatile markets. However, it requires careful consideration of multiple variables and their potential interactions.

7. Combined Approaches:

Many forecasting methodologies are not mutually exclusive. Effective forecasting often involves a combination of approaches to harness the strengths of each method. For example, statistical models can be enriched with qualitative insights from industry experts.

Considerations: Combining approaches requires a nuanced understanding of how different methodologies complement each other. It may also involve complex data integration and analysis.

In the ever-evolving landscape of CMC pricing, the choice of forecasting methodology should align with the specific needs and resources of industry stakeholders. A comprehensive approach that integrates quantitative and qualitative insights, leverages technology, and remains adaptable to changing market conditions is likely to yield the most accurate and reliable forecasts. In the subsequent section, we will apply these methodologies to forecast CMC prices within the context of petroleum drilling operations, providing a practical illustration of their utility.

Carboxymethyl Cellulose Price Forecasting for Petroleum Drilling Operations

Now, armed with an understanding of the factors influencing Carboxymethyl Cellulose (CMC) pricing and a range of forecasting methodologies, we turn our attention to the practical application of these methods in forecasting CMC prices specifically for petroleum drilling operations.

1. Statistical Models in Action:

One of the most widely used methods in CMC price forecasting is statistical modeling. Here's how it works in practice:

- Data Collection: Historical pricing data for CMC, including factors such as raw material costs, drilling activity levels, and economic conditions, is collected and organized.

- Model Selection: Based on the dataset and the desired level of complexity, an appropriate statistical model is selected. Time series analysis, regression models, and machine learning algorithms are common choices.

- Model Training: The selected model is trained using historical data, allowing it to identify patterns, correlations, and potential drivers of CMC prices.

- Forecasting: With the model trained, it can now generate forecasts for future CMC prices based on input data. These forecasts can include short-term and long-term projections, enabling drilling operations to plan effectively.

2. Market Analysis and Expert Insights:

In parallel with statistical modeling, qualitative methods such as market analysis and expert insights come into play:

- Market Assessment: Industry experts and analysts continually assess the broader petroleum drilling industry, including drilling activity trends, oil prices, and regulatory changes. They provide ongoing insights into the market's health and potential impact on CMC prices.

- Expert Consultation: Manufacturers, suppliers, and professionals in the drilling field offer their expert opinions on CMC price trends. Their insights, grounded in industry knowledge, can provide valuable qualitative data.

3. Technology and Data Analysis:

Advanced data analysis and technology-driven approaches further enhance forecasting:

- Data Integration: Multiple data sources, including real-time market data, drilling activity reports, and economic indicators, are integrated into a centralized analytics platform.

- Machine Learning: Machine learning algorithms are employed to analyze vast datasets and identify intricate patterns that may not be apparent through manual analysis alone.

4. Scenario Planning for Risk Mitigation:

Scenario planning is essential for managing price volatility:

- Multiple Scenarios: Different scenarios are developed based on various combinations of price-driving factors. These scenarios consider variables such as oil price trends, economic conditions, and geopolitical events.

- Risk Mitigation: Each scenario assesses the potential impact on CMC prices and allows drilling operations to implement risk mitigation strategies tailored to specific scenarios.

By implementing these methodologies in a cohesive and integrated manner, drilling operations can achieve more accurate and robust CMC price forecasts. These forecasts serve as essential decision-making tools, enabling operations to proactively manage costs, optimize resource allocation, and respond effectively to market dynamics.

Accurate price forecasting empowers petroleum drilling operations to navigate the complex landscape of CMC pricing with confidence, enhancing overall cost-effectiveness and operational efficiency. It's a testament to the importance of blending data-driven insights with industry expertise to make informed decisions in this critical sector. In the following section, we will delve into real-world case studies that demonstrate the practical relevance and impact of CMC price forecasting in petroleum drilling operations.

In conclusion, the world of Carboxymethyl Cellulose (CMC) price forecasting in petroleum drilling operations is a complex yet indispensable aspect of the industry. We've explored the multifaceted factors influencing CMC pricing, various forecasting methodologies, and practical applications through real-world case studies.

CMC pricing is not merely a financial consideration; it's a strategic imperative for drilling operations. Accurate forecasting empowers these operations to navigate pricing fluctuations, optimize resources, and maintain competitiveness.

As we step back from this journey, we recognize that CMC plays a pivotal role in an industry that drives global progress. The insights gained from CMC price forecasting serve as a reminder of the importance of data-driven decision-making, industry collaboration, and adaptability in the petroleum drilling sector.

With these tools and insights, drilling operations can confidently chart their course through the challenges of pricing dynamics, ensuring stability and prosperity in this critical field.

References and Further Reading

- Smith, J. R., & Petrov, A. N. (2020). Predictive Modeling for Commodity Prices: A Comprehensive Overview. Academic Press.

- Gupta, S., & Shah, V. (2019). Statistical Methods and Applications in Oil and Gas Data Analytics. Springer.

- International Journal of Petroleum Science and Technology, (2018). Market Trends and Forecasting in the Oil and Gas Industry.

- Brown, R. M., & Sullivan, P. A. (2018). Biological and Biomedical Applications of Carboxymethylcellulose. Springer.

- Oil & Gas Journal. (Accessed 2023). Oil Price News and Analysis.

- Society of Petroleum Engineers (SPE). (Accessed 2023). Technical Papers and Publications.

- International Journal of Drilling and Well Engineering. (Accessed 2023). Latest Research in Drilling.

- Petroleum Economist. (Accessed 2023). Oil & Gas Industry Analysis.

- LINYI VIHO CHEM CO.,LTD

- Wechat: 17762049811

- Tel: +86-17762049811

- Mobile: +86 17762049811

- Address: Lizhuang Town, Linyi, Shandong